“The proverb, ‘What you don’t know can’t hurt you”, originated in 1576 as, ‘So long as I know it not, it hurteth mee not.’ But the opposite is true. Unpleasant hidden truths do the most harm. The best way to fight corruption is to expose it. Think of the World Bank as ENRON.” … Karen Hudes

by Karen Hudes (with Jim Fetzer)

When, thanks to Mark Novitsky, a federal whistleblower, I learned that Karen Hudes, who earned her J.D. at Yale, our most distinguished School of Law, and an M.Phil. in economics at the University of Amsterdam, which is also a formidable institution, had been removed from her position as Senior Counsel for the World Bank because of her efforts to expose corruption and reaffirm the rule of law in the form of appropriate standards of accounting, I was dumbfounded.

What initially appear to be obscure issues of international finance, moreover, have the potential to sever ties between us and our NATO allies and weaken the national security of the United States. The stakes involved are therefore extremely high for every American citizen.

During the World Bank and IMF Annual Meetings last October, with her encouragement, the Development Committee informed President Jim Yong Kim of the need for “a more open, transparent and accountable World Bank Group.” The reasons that motivated that request included the following series of disturbing developments:

- The World Bank has disregarded the Joint Economic Committee’s 2005 inquiry into the World Bank’s “corporate governance irregularities” and “accounting problems”;

- The World Bank has failed to follow the Joint Economic Committee’s advice that professional financial and accounting employees be given independent access to the World Bank’s Board and its Audit Committee;

- The World Bank has failed to protect Hudes against retaliation for challenges of illegality or other misconduct through external arbitration pursuant to the 2005 Lugar-Leahy amendment, which could threaten its mission;

- The World Bank has stonewalled Senator Lugar’s and Congressman Van Hollen’s four requests for the advice of the executive search firm following Hudes’ disclosure of internal control lapses;

- The World Bank has refused to comply with the Government Accountability Office inquiry into corruption requested by Senators Lugar, Leahy and Bayh for more than three years;

- Congress has reiterated its request for the GAO inquiry during hearings on the World Bank capital increase, with which it has yet to comply; and,

- Treasury Secretary Timothy Geithner misrepresented progress on World Bank reform in his 11/21/12 report to the Appropriations Committees pursuant to § 7082 of the Consolidated Appropriations Act of 2012.

The Crisis in Cyprus as a Mini-Model

The threat by EU bankers to loot savings accounts held in Cyprus has raised red flags all over the world. As The New York Times (25 March 2013) has reported,

LIMASSOL, CYPRUS — It is not just about rich Russians and Cypriot retirees. Also vitally at stake in this island country’s banking crisis is Cyprus’s credibility as a place for international companies to continue doing business. Take Avid Life Media, the Canadian-owned operator of some of the world’s biggest online dating sites. Only a few weeks ago it set up an office here as a base for its international operations, attracted to Cyprus — as hundreds of other foreign businesses have been — because of its reputation for financial stability, a low corporate tax rate, a friendly banking environment and most of all, a strong rule of law.

Now imagine that was the case for the most important bank of all, which affects the world’s economy. Imagine that bank accounts were being looted world-wide and you will begin to appreciate the dimensions of the problem.

When I discovered that Karen Hudes’ reinstatement, which was being supported by the finance ministers of the nations of the world, was being blocked by its recently appointed president, Jim Yong Kim, who was formerly President of Dartmouth, I was further astonished, because I had encountered Kim before. He had supported the publication for an article by a member of the computer science faculty, Hany Farid, who claimed that the backyard photographs used to convict Lee Harvey Oswald in the public mind were authentic, which was profoundly disturbing.

Hany Farid and “the backyard photographs”

That is a claim that others had long since proven false. Jack White, the legendary JFK photo analyst, had testified to the House Select Committee on Assassinations (HSCA) when it had reinvestigated the deaths of JFK and of MLK in 1976-77 and had pointed out a dozen features that disqualify them. Oswald himself had told Capt. Will Fritz, the Dallas Homicide detective who interrogated him, that the photo he was shown had his face pasted on someone else’s body. Like other claims Oswald made at the time, subsequent research has proven that he was right. The chin is not Lee Oswald’s chin, which was somewhat pointed, but a block chin; there is an insert line between the chin and his lower lip; and the finger tips of his right hand are cut off, for example.

Even more interestingly, he realized that the two communist newspapers that Oswald was holding–The Militant and The Worker–had known dimensions and could serve as an internal rule to determine the height of the person who was holding them. Using that method, he was able to establish that he was about 5’6″ tall, when Oswald was about 5’10”–which meant that either someone who was too short to be Oswald had posed for the photos or that they had been introduced too large when they were faked. Either way, they could not possibly be authentic.

When I discovered that Hany Farid, who has a lab funded by the FBI, had published the claim that he had proven them to be authentic by showing that it was possible to replicate the shadow cast by the nose in one of them, I knew he was perpetrating a fraud on the public, because (1) there are four poses taken in different positions at different times, where it would have been virtually impossible for the nose shadow to remain constant from one to another; and (2) there are many other indications of fakery besides the shadow cast by the nose that prove fakery, where even if he had been right about the nose shadow, his conclusion of authenticity would have been wrong. He was violating a basic precept of science by not basing his reasoning upon all the available relevant evidence.

So I wrote to President Kim to explain why Darmouth was committing a blunder in supporting Hany Farid’s claim, which I substantiated with multiple lines of proof. Dartmouth stood pat, however, and never took steps to correct the record, even though it was a matter of immense public interest and concern. I published an article about my experience with Kim in an article co-authored with Jim Marrs in OpEdNews, “The Dartmouth JFK-Photo Fiasco” (20 November 2009) and followed up by publishing my correspondence in “Blowing the Whistle on Dartmouth: Hany Farid in the nation’s service” (26 January 2010), which I regarded as a professional obligation.

It now appears to me that Kim may have been rewarded for his contribution to the public deception about the death of JFK by being appointed to the World Bank, just as Paul Wolfowitz appears to have been appointed by George W. Bush for his contributions to 9/11 and the “war on terror”. I have long believed that, in Washington, D.C., the bigger the liar, the further you go. I now believe that, when it comes to acting contrary to the public interest, the presidency of the World Bank may be another sign of compliance with corruption, as the experiences of Karen Hudes reflects. I regard us as kindred spirits insofar as “whistle blowing” seems to be coursing through our veins.

Credit Ratings, NATO and Democracy: Too Big for Transparency?

by Karen Hudes

The World Bank and its next door neighbor, the International Monetary Fund (IMF), stand at the crossroads of the international financial system. Both organizations are referred to as the “Bretton Woods” institutions, named for the site in New Hampshire where the founding conference of 44 countries was held in 1944. The Bretton Woods institutions were created to prevent the “beggar thy neighbor” policies responsible for World Wars I and II. The World Bank’s membership has now grown to 188 countries.

The World Bank and IMF share a Board of Governors comprising the Ministers of Finance of member countries. They each have resident Boards of 24 Directors; seven Directors are appointed by 7 countries with the largest economies and 17 Directors are appointed by groups or “constituencies” of the remaining member countries. Because of its crucial role at the heart of the world’s financial system, problems at the World Bank are going to have consequences for the world’s financial system.

I know “up close and personal” because I served as Senior Counsel for the World Bank for 21 years. My qualifications included a J.D. from Yale Law School and M.Phil. in economics from the University of Amsterdam. I know the institution inside and out. And I have been blowing the whistle on improper practices at the World Bank that threaten the world’s fiscal integrity.

Reporting Corruption up the Chain of Command

I worked in the Legal Department of the World Bank from 1986-2007. But in 2007, I was fired in retaliation for reporting corruption at the Bretton Woods institutions up the chain of command at the World Bank, through the US Treasury Department, and to the US Congress. My report was quite specific, namely: that the World Bank is out of compliance with the law, because its financial statements to the holders of its $135 billion in bonds, which are denominated in 52 currencies, are not in accord with Generally Acceptable Accounting Principles and Auditing Standards. I never imagined how intractable the corruption at the World Bank was.

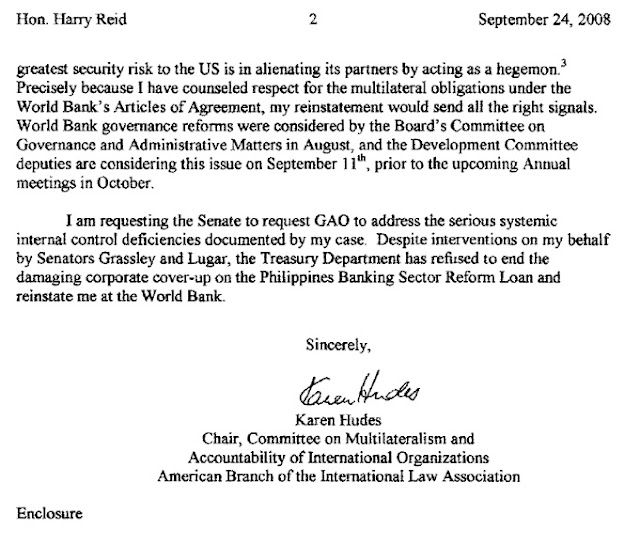

A reliable stakeholder analysis, based on game theory modeling, shows that failure to adhere to the rule of law by the World Bank will bring about a world-wide currency war that will make what we lived through in 2008 pale by comparison. The stakeholder analysis began predicting success in bringing the World Bank into compliance after the European Parliament invited me to testify on May 25, 2011. My testimony included a chronology of the cover-up. President Kim has already prompted Germany to repatriate the equivalent of $36 billion in gold. As I told Sen. Harry Reid in 2008, “the greatest security risk to the US is in alienating its partners by acting as a hegemon”.

The Failure of Press Coverage

One reason it is so difficult to end the corrupt regime at the World Bank is because there has been virtually no press coverage. It is possible to conclude from this that democracy in the United States

has been weakened by thereduction in the number of corporations who own the bulk of US media outlets (from 50 to 5 in less than twenty years.) Barclays Bank, JPMorgan Chase & Co, The Goldman Sachs Group along with a few others use interlocking corporate ownership to control 40 percent of total wealth and 60 percent of global revenues. This concentration of power rests on disproportionate corporate investments of one percent of all corporations. Theorists at the Swiss Federal Institute of Technology in Zurich, using natural systems mathematical modeling and comprehensive data on the actual corporate ownership of 43,000 transnational corporations, discovered this concentration of power.

When questions are raised about “who controls the world”, this one percent looks like a very promising candidate. The crux of the matter is that the corporations control the mass media and, through the mass media, control the politicians. Although there have been occasional articles about these issues, where some of my commentaries about them have appeared in print, for the most part, interest in these questions from the public has been few and far between, where recent interviews with Deanna Spingola and with Jim Fetzer, who are alternative media radio hosts, have been the exception. Here are some links to our recent interviews:

- “Spingola Speaks” with Karen Hudes, 22 January 2013, HOUR 1 The Interview

- “Spingola Speaks” with Karen Hudes, 22 January 2013, HOUR 2, The Interview

- “The Real Deal” with Karen Hudes, 6 March 2013, 1.5 HOURS, The Interview

- “The Real Deal” with Karen Hudes, 20 March 2013, .5 HOUR, The Interview

[NOTE: Both interviews are followed by discussion with Mark Novitzky.]

The Early Years of the World Bank

The longest-serving General Counsel of the World Bank, Aaron Broches, helped to write the charters of the World Bank and IMF at the Bretton Woods conference in 1944. According to Broches, corruption intensified during former Secretary of Defense Robert McNamara’s presidency of the World Bank from 1968-81. In 2007, the Board fired another president from the Pentagon, Paul Wolfowitz, after Wolfowitz gave a 35% salary increase to his girlfriend at the World Bank, Shaha Riza. The Europeans asked for an inquiry.

The investigation headed by Paul Volcker, unfortunately, did not address the corruption. The Europeans reacted by calling for an end to the 66 years’ “Gentlemen’s Agreement” that the US appoints the President of the World Bank and the Europeans appoint the Managing Director of the IMF. Had the press reported my warnings to the authorities about the corruption, the US could have avoided substantial tarnish to its reputation and the loss of the Gentlemen’s Agreement. My efforts to expose and correct the failure of the World Bank to adhere to standard accounting procedures has been enduring.

In 2005, for example, the Dutch Government asked the Audit Committee to end a campaign of retaliation against me for reporting to the Executive Board about an inaccurate evaluation on a failed Banking Sector project in the Philippines. Then Senator Richard Lugar (R-IN) and the Senate Committee on Foreign Relations have written three letters to the World Bank on my behalf, asking for an end to the ongoing cover-up.

My Efforts to Expose Corruption

In 2007, I also met with Chris Armstrong in Senate Finance, Jayme Roth in Senator Bayh’s office, and Nicole Willet in Senator Clinton’s office. Senators Lugar, Leahy and Bayh began asking GAO to investigate the World Bank in 2008,

and the Audit Committee is requiring an independent audit of the World Bank’s internal controls. The Audit Committee also referred my case to the Bank’s Institutional Integrity Department (INT). INT, which reports to the President of the World Bank, is used to intimidate staff.

Paul Volcker ignored INT’s sinister role and simply recommended that whistleblower retaliation cases should be removed from INT’s mandate. I met with the Ministry of Foreign Affairs of the Dutch Government on 24 September 2007. The Dutch are not happy with the Volcker Report and the ongoing cover-up. Moreover, previous Dutch Executive Directors, Herman Wijffels and Ad Melkert, disclosed that ‘third parties’ attempted to intimidate them and other members of the World Bank’s Board through shocking invasions of their private lives. The US violation of the safe-conduct normally accorded to diplomats is an egregious breach of honor.

Article VII, Section 8 of the World Bank’s Articles provides immunities to Executive Directors, officers and staff. Ben Heineman (who was a member of the Volcker Panel) spoke at the Yale Law School on October 5, 2007. On October 8, 2007, at the suggestion of minority staff on the Senate Foreign Relations Committee, I contacted Kenneth Peel at Treasury, to encourage the Bush Administration to end the cover-up on the Philippines Banking Sector Reform Loan and restore the rule of law to the Bank. But the upshot of my efforts to correct improper procedures was to have me removed from my position as Senior Counsel, which has had an intimidating effect.

The Crucial Year 2007

I wrote to the Dean of the School of Law at Yale, Robert Post, on 14 October 2007 to express my appreciation for his offer of assistance in exposing the scandal. I included an email that I had sent to The Wall Street Journal in an effort to correct the false impression it had conveyed about the Volcker Panel report, but it was to no avail. Here is what I wrote him:

Dear Bret, I am a regular reader of your column, and wanted to set you straight about my next-door neighbor, Suzanne Folsom, and her role as Director of the World Bank’s Institutional Integrity Department. INT’s function under Ms. Folsom is not as you described in your column today. Ms. Folsom has continued to direct INT along the same lines as her predecessor Maarten de Jong: as a “goon squad” that intimidates any staff member who steps out of line and informs the Board of Directors about what is actually happening at the World Bank.

Until August 1, 2007 I was in-house counsel at the World Bank, and fulfilled my ethical obligations to report to the Audit Committee about a cover-up on a failed Banking project in the Philippines which resulted in the corrupt take-over of the second largest Bank in the Philippines, a $493 million bail-out from Philippines Deposit Insurance Corporation when depositors lost confidence in Philippines National Bank, the cancellation of $200 million from the World Bank’s associated loan to the Government of the Philippines, and the cancellation of $200 million in financing from Japan.

Instead of defending me, INT attacked me in a flawed report to the Audit Committee. I am not the only whistleblower whom INT has attacked. The Senate is fully aware of this scandal at the World Bank, which served as a poignant backdrop to Mr. Wolfowitz’ forced departure. The Europeans are withdrawing their funding from the World Bank in favor of the European Investment Bank as a result of these severe governance issues. Relevant documentation is attached to this email. Because of AOL’s limitation on the size of files that may be attached to emails, I will forward other supporting documentation to you separately.

I sent The Wall Street Journal a set of the following, extremely important, documents, expecting that the cover-up would end. I did not anticipate that a small elite group who owned the press was stealing democracy from US citizens by censoring what could be published by the media.

- An annotated version of the World Bank’s Administrative Tribunal decision

- My memorandum to the Institutional Integrity Department

- A memo concerning rule of law at the World Bank

Here is another letter concerning the misrepresentation of the effects of the Volcker panel, which I sent on August 30, 2007:

Dear Mr. Heineman, I have informed the Senate about the World Bank’s failure to prevent the corrupt take-over of Philippines National Bank during supervision of the Philippines Banking Sector Reform Loan and the flawed report of the Institutional Integrity Department (“INT”) to the Board’s Audit Committee on this serious matter. The Senate Foreign Relations Committee, concerned about the US reputation for probity, wrote to the World Bank three times requesting an end to the cover-up. Ignoring recent legislation mandating whistleblower protections, the World Bank retaliated against me after I continued to report internal control lapses up the management chain. Both Messrs. Zoellick and Debevoise refused to provide the whistleblower protections that the Senate, in fulfilling its oversight responsibilities, had specifically requested on my behalf.

Ana Palacio, the General Counsel, terminated my employment in the World Bank’s Legal Department on July 31, 2007 after sabotaging my transfer to the External Affairs Department, where I was to establish a global partnership involving the American Bar Association, the International Legal Assistance Consortium, the UNDP, the State Department, and the Center for International Legal Cooperation. I have devoted my career to the World Bank, designed as a cornerstone of the global public commons when it was created at the end of World War II.

Paul Volcker’s interim report failed to address INT ‘s sinister role in attacking whistleblowers, widely understood by staff and members of the Board alike. The documentation on my case leaves no doubt about INT’s lack of integrity, but there are other cases that provide serious indictments of INT as well. The Europeans have been withdrawing their support from the World Bank in favor of the European Investment Bank as a consequence of the failure of the US to play by the rules within the Bank. A highly accurate stakeholder analysis has predicted that the Gentleman’s Agreement, whereby the US appoints the president of the World Bank and Europeans appoint the managing director of the IMF, will not continue if the US continues to circumvent the rule of law at the World Bank.

I am forwarding a copy of this stakeholder analysis (see page 17 of attached Correspondence), which I have also provided to the Senate and State Department. On July 23, at an open meeting of the Legal Department, Mr. Zoellick asked me whether the World Bank has a Sarbanes Oxley problem, and then asked me to help him solve it when I answered his question in the affirmative. I am requesting the Volcker Panel to carry out its mandate by ending the cover-up on the Philippines Banking Sector Reform Loan and resolving the associated internal control lapses and governance crisis within the World Bank.

Congressional Oversight

Republicans and Democrats in Congress tried to expose the corruption to the American public by calling for an inquiry by the Government Accountability Office. When the very rich group that owns the media in the United States refused to cooperate with the GAO, both political parties remained divided. On May 19, 2008, Sen. Grassley’s aide in the Senate Finance Committee advised me to request Joe Biden, Barack Obama, and Hillary Clinton to end the cover-up, which I did in a letter to them of May 19, 2008:

Subject: Re: Multilateralism at the World Bank Dear Senators Clinton, Obama and Mikulski and Congressman Van Hollen, In response to lapses in internal controls at the World Bank, Senators Lugar, Leahy and Bayh have called for an audit by the Government Accountability Office. On May 14th Chris Armstrong [Senator Grassley’s Aide on the Senate Finance Committee] asked me to inform you about a cover-up of the World Bank’s supervision mistakes and corruption in the Philippines Banking Sector Reform Loan. I will be stopping by later today with additional documentation showing the US’ behavior as a hegemon at the World Bank:

* the US violated diplomatic immunities by investigating Executive Director’s bank accounts to intimidate them and prevent them from holding Paul Wolfowitz accountable for giving his girlfried Shaha Riza exhorbitant salary increases. (Eliot Spitzer was victim of a similar investigation.)

* the US gave narrow terms of reference to the Volcker Panel to exclude the Panel from investigating the goon squad behavior of the Institutional Integrity Department. INT attempted to intimidate me in order to perpetuate an incorrect evaluation of the Bank’s performance on the Philippines Banking Sector Reform Loan and cover-up the Bank’s supervision mistakes on that project. As a result, the Volcker Panel’s recommendations do not address internal control problems raised by INT’s lack of independence.

* the US has ignored appropriations legislation and letters from the Committee on Foreign Relations requiring whistleblower protections at the World Bank.

The US failure to respect the multilateral governance structure and its obligations under the Articles of Agreement creating the World Bank raise Constitutional law issues. In April 2010, the European Community renounced the Gentleman’s Agreement which had been in effect since 1945 whereby the US appoints the President of the World Bank. During hearings on a capital increase for the World Bank, Senator Lugar had this to say about the World Bank’s continuing to stonewall the GAO inquiry:

“A few years ago, I joined then-Senator Biden, Senator Leahy, Senator Bayh, and others in asking the Government Accountability Office to conduct a review of the World Bank regarding its ability to fight corruption and to conduct environmental assessments. But, at that time, the GAO did not receive clearance from the World Bank to commence its work. What is delaying that review and what could be done to ensure that the GAO has the ability to carry out its work in this endeavor?” GAO is now facing $50 million in budget cuts.

SEC and Federal Reserve

The World Bank’s Audit Committee appointed KPMG to audit the World Bank’s internal control over financial reporting. When KPMG did not follow Generally Accepted Audit Principles and Standards, the UK’s Serious Fraud Office called the US Securities and Exchange Commission. The World Bank’s access to the capital markets is regulated by the Chairman of the SEC and the National Advisory Council on International Monetary and Financial Policies.

I asked the Chairman of the Federal Reserve, Secretary of State, and other members of the NAC, “May the World Bank retaliate against persons who inform US Congress and the Board of Governors of the World Bank’s compliance issues?” and whether “KPMG [was] entitled to give false and misleading audit opinions to IBRD’s bondholders?” The Ombudsman of the Federal Reserve acknowledged that “I further understand that you are concerned that these issues threaten the World Bank’s credit rating and the stability of the international financial system,” but claimed that my complaint did not fall within the Federal Reserve Board’s authority. I responded that, since Chairman Bernanke had not recused himself when I first wrote to him, “any belated attempts now are ineffectual.”

UK Fires Secretary of International Development

which has recommended that the UK reduce its contribution to the World Bank pending further study. On October 3, 2011, I informed Secretary Geithner of this fact during his testimony to the House Committee on Financial Services. The UK’s Financial Reporting Council is investigating KPMG’s failure to follow auditing standards.

The UK replaced Andrew Mitchell as Secretary of International Development on September 4, 2012. Another positive development is that the individual states also regulate the World Bank under blue sky laws. I have been informing the attorneys general, governors, and chief justices of the World Bank’s compliance issues. Congress is requiring the World Bank to make significant progress in protecting its whistleblowers before funds for the World Bank’s capital increase are disbursed under Section 7082 of the Consolidated Appropriations Act of 2012, signed into law on December 23, 2011.

The National Taxpayer’s Union has a petition about this corruption and initiated a blog about my efforts as a whistle blower about the World Bank. As I informed Congressional appropriations committees, “The Treasury Department should be sanctioned for its report to the Appropriations Committees dated November 21, 2012 on World Bank Reform pursuant to Section 7082 of the Consolidated Appropriations Act, 2012. The uncertified report is inaccurate in all material respects.”

Corruption in the Federal Courts

As the cover-up continued, I bought a World Bank bond and sued the World Bank and KPMG under

the securities laws. I also sued the World Bank’s medical insurance administrator for disclosing the names of my doctors so that the World Bank could question my mental health and defame me. The Judge in the District Court dismissed my case, ignoring that the World Bank was not immune in lawsuits brought by bondholders. My case in the Court of Appeals was assigned to the same panel that refused rights under the Constitution to prisoners in Guantanamo Bay.

My computer was hacked to destroy my brief at midnight the day before a filing deadline in the Court of Appeals. I retrieved an earlier draft from the clouds and stayed up all night to file on time. On the way to the court I was disoriented by directed energy weaponry. The Court of Appeals invalidated the filing on a minor technicality, but I managed to refile later in the day electronically. The Panel issued a hasty non-published opinion the day after I blogged that the Board of the World Bank would take over supervision of the litigation because the World Bank General Counsel was conflicted out.

- The Clerk disregarded my advice that the Board of Governors and I had settled the case. In response, Germany announced the repatriation of 674 tons of gold valued at $17.9 billion from the NY Federal Reserve.

- The Federal Reserve Board’s cover-up of this corruption caused a lowering of the US credit rating. The credit rating agencies are poised for a further downgrade in the US credit rating because voters are uninformed on this cover-up of corruption.

- Mitt Romney appointed Robert Zoellick, the former President of the World Bank, as his national security transition planning chief. In the final debate for the US presidency, Bob Schieffer did not ask Mitt Romney or Barack Obama what they intend to do to fight international corruption.

- I informed Chief Justice John Roberts, Jr. that the Conference of Chief Justices and the Board of Governors of the World Bank were waiting for the Judicial Conference to correct this mistake in the Court of Appeals.

Where things stand

his voice to me. The World Bank, under Dr. Kim’s presidency, called the DC police on a legal officer of the World Bank whose reinstatement was necessary in order to qualify for the US contribution to the World Bank’s capital increase. Notwithstanding that the World Bank refused to confirm any request to the police in writing in an attempt to evade accountability, I left the premises at the request of the DC police. However, I did report to the 2nd District Precinct that the DC police had been derelict in their duties.

Republicans and Democrats in Congress have tried to expose the corruption to the American public by calling for an inquiry by the Government Accountability Office. Congress has attempted to fight the corruption by refusing to disburse the World Bank capital increase until there is substantial progress in eliminating the effects of retaliation against whistleblowers who disclosed illegality and corruption. The UK and EU Parliaments have also published testimony and held hearings on the corruption.

The World Bank has attempted to intimidate the World Bank’s Board members, which violates federal, state, and international securities laws.[1] Fortunately, a team of whistleblowers disclosed this corruption and lawlessness to state governors, attorneys general, and chief justices of state supreme courts. State authorities, together with NATO and other allies, are attempting to prevent this corruption from lowering the US credit rating and causing a currency war between nations.

The situation in Cyprus appears to be growing increasingly more serious. The prospects for the World Bank itself are also increasingly in jeopardy, where Brazil, Russia, India, China and South Africa (the BRICS nations) are planning to create their own alternative World Bank. These consequences might well have been avoided had President Kim adhered to the principles of the rule of law, reinstated me and implemented appropriate accounting procedures. That he has done none of these, alas, remains a cause of grave concern, where his past performance in relation to JFK is anything but reassuring.

Karen Hudes, J.D., maintains the Law Offices of Karen Hudes in Washington, D.C. She served as Senior Counsel for the World Bank for 21 years and maintains a web site at www.kahudes.net.

eToro is the most recommended forex broker for beginning and advanced traders.

If you would like an alternative to casually approaching girls and trying to find out the right thing to say…

If you would rather have women hit on YOU, instead of spending your nights prowling around in crowded pubs and night clubs…

Then I encourage you to watch this short video to unveil a strong little secret that might get you your very own harem of beautiful women just 24 hours from now:

FACEBOOK SEDUCTION SYSTEM!!!

Two problems, possibly three. The dog ate her homework in the form of a ''hacking'' attack the night before she was to hand in a form.

Also, there's a problem if she's a U.S. citizen; U.S. citizens can't buy World Bank bonds.

And last but not least, the bit about being attacked by ''directed energy weapons.''